The Role of Accountants in Unraveling Financial Insights in Philly

Accountants play a crucial role in unraveling financial insights in Philadelphia. With their expertise in analyzing and interpreting financial data, they are the masters of the balance sheet. In this article, we will explore the importance of accountants in providing valuable insights into the financial health of businesses in Philly.

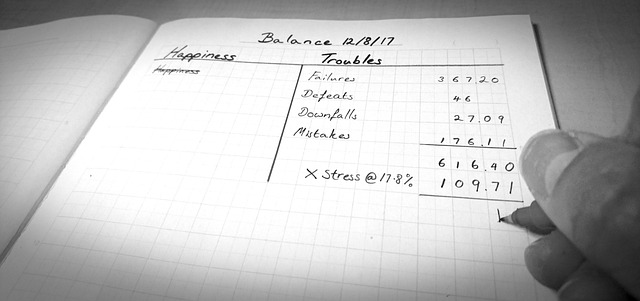

One of the primary responsibilities of accountants is to prepare and maintain financial statements, including the balance sheet. The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and shareholders’ equity. Accountants meticulously analyze these figures to assess the financial health of a business.

By examining the assets section of the balance sheet, accountants can determine the company’s liquidity and solvency. Liquidity refers to the company’s ability to meet its short-term obligations, while solvency refers to its ability to meet long-term obligations. Accountants assess the composition of assets, such as cash, accounts receivable, and inventory, to gauge the company’s ability to generate cash flow and cover its debts.

Similarly, accountants scrutinize the liabilities section of the balance sheet to evaluate the company’s financial obligations. They analyze the types and amounts of liabilities, such as accounts payable, loans, and accrued expenses, to assess the company’s ability to meet its financial commitments. This analysis helps identify potential risks and areas of concern that may impact the company’s financial stability.

Accountants also delve into the shareholders’ equity section of the balance sheet to understand the company’s capital structure. They examine the company’s retained earnings, common stock, and additional paid-in capital to assess the company’s financial leverage and the shareholders’ stake in the business. This analysis provides insights into the company’s financial stability and its ability to attract investors.

In addition to analyzing the balance sheet, accountants also play a crucial role in financial forecasting and budgeting. They use historical financial data and industry trends to project future financial performance. By analyzing revenue and expense patterns, accountants can help businesses make informed decisions about resource allocation, cost management, and revenue generation.

Accountants also assist businesses in complying with financial regulations and reporting requirements. They ensure that financial statements are prepared in accordance with generally accepted accounting principles (GAAP) and other relevant regulations. By providing accurate and reliable financial information, accountants help businesses build trust with stakeholders, including investors, lenders, and regulatory authorities.

Furthermore, accountants play a vital role in financial analysis and decision-making. They provide insights into the financial implications of various business decisions, such as mergers and acquisitions, capital investments, and cost-cutting measures. Their expertise in financial analysis helps businesses make informed decisions that align with their strategic objectives and maximize shareholder value.

In conclusion, accountants are the masters of the balance sheet and play a crucial role in unraveling financial insights in Philadelphia. Through their expertise in analyzing and interpreting financial data, they provide valuable insights into the financial health of businesses. From assessing liquidity and solvency to evaluating capital structure and financial forecasting, accountants help businesses make informed decisions and comply with financial regulations. Their role is indispensable in ensuring the financial stability and success of businesses in Philly.