Accounting Basics: A Guide to Managing Your Finances

Managing your finances effectively is crucial for achieving financial stability and success. Whether you are an individual or a business owner, understanding the basics of accounting is essential. In this guide, we will provide you with some valuable tips to help you manage your finances more effectively.

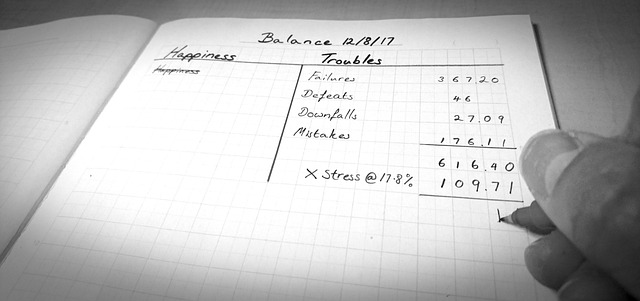

First and foremost, it is important to establish a budget. A budget allows you to track your income and expenses, giving you a clear picture of your financial situation. Start by listing all your sources of income and then categorize your expenses. This will help you identify areas where you can cut back and save money. Remember to review and update your budget regularly to ensure it remains accurate and reflects any changes in your financial situation.

Another important aspect of managing your finances effectively is keeping track of your expenses. This can be done through various methods, such as using a spreadsheet or a personal finance app. By recording your expenses, you can easily identify where your money is going and make necessary adjustments. Additionally, tracking your expenses allows you to identify any unnecessary or excessive spending habits that you can eliminate.

In addition to tracking your expenses, it is crucial to save money regularly. Saving money not only provides you with a financial safety net but also allows you to invest and grow your wealth. Start by setting aside a portion of your income each month and gradually increase the amount as your financial situation improves. Consider opening a separate savings account to keep your savings separate from your everyday spending.

Furthermore, it is important to manage your debt effectively. Debt can quickly become overwhelming if not managed properly. Start by prioritizing your debts and paying off high-interest debts first. Consider consolidating your debts or negotiating with creditors to lower interest rates or payment plans. It is also important to avoid taking on unnecessary debt and to only borrow what you can afford to repay.

Another tip for managing your finances effectively is to establish an emergency fund. Life is unpredictable, and unexpected expenses can arise at any time. Having an emergency fund can provide you with peace of mind and financial security. Aim to save at least three to six months’ worth of living expenses in your emergency fund. This will ensure that you are prepared for any unforeseen circumstances, such as job loss or medical emergencies.

Lastly, it is important to educate yourself about personal finance and accounting principles. Understanding the basics of accounting will help you make informed financial decisions and avoid common pitfalls. Consider taking a personal finance course or reading books on the subject. Additionally, seek advice from financial professionals, such as accountants or financial advisors, who can provide you with personalized guidance based on your specific financial situation.

In conclusion, managing your finances effectively is crucial for achieving financial stability and success. By establishing a budget, tracking your expenses, saving money, managing your debt, establishing an emergency fund, and educating yourself about personal finance and accounting principles, you can take control of your finances and work towards your financial goals. Remember, managing your finances is an ongoing process, so regularly review and update your financial plan to ensure it remains effective.